Navigating the realm of small-cap stocks can present both immense potential and inherent volatility. For investors targeting to tap into this dynamic market segment, exchange-traded funds (ETFs) like the iShares S&P Small-Cap 600 Growth ETF (IWM) and the SPDR S&P SmallCap 600 ETF (EW小 have emerged as popular choices. These ETFs offer a focused approach to investing in small-cap companies, allowing investors to allocate their portfolios across a broad range of sectors and industries.

While both UWM and IWM track the performance of growth-oriented companies, their underlying benchmarks differ, resulting in distinct risk profiles. Understanding these nuances is crucial for investors to formulate a portfolio that corresponds with their specific aspirations.

- Utilizing ETFs like UWM and IWM can provide a strategic means to gain exposure to the growth potential of small-cap stocks, but it's essential for investors to conduct thorough research and consider their own financial situation.

Unlocking the Power of TZA for Shorting Volatile Small Caps

Volatility in the small-cap market can be a blessing and a curse. While it presents opportunities for massive gains, it also carries substantial risk. But what if you could lever up your short positions on these wild rides? Introducing TZA, the powerful exchange-traded fund designed to exploit the swings of the small-cap universe. With its unique three times leveraged strategy, TZA provides a advanced approach to navigating this volatile space.

- TZA's strategy allows investors to benefit from market downturns in the small-cap sector, offering a hedge against potential losses.

- Whether you're looking for amplified gains, TZA provides a attractive tool to consider.

It's important to remember that TZA is designed for experienced investors with a high risk tolerance. Its leveraged nature can magnify both rewards and setbacks. Conduct thorough research and understand the potential dangers involved before investing in any leveraged ETF.

Conquering the Micro Market: A Battle of Giants - UWM vs. TZA

Buckle up, aggressive traders, because the small-cap arena is heating up! This week we're diving into a high-octane showdown between two titans: The UWM behemoth. On one side, you have the TZA ETF , representing a basket of undervalued small-cap gems. Will this diversified force be able to withstand the laser focus of UWM? Can this mortgage lender continue its winning streak in this volatile market?

Only time will tell, but one thing's for sure: this battle promises to be exhilarating. Keep your eyes on the charts and your trading strategies sharp – because in the world of small caps, every swing can be a game-changer.

Unlock Small-Cap Potential: VTWO and IWM for Portfolio Diversification

Seeking returns in the dynamic small-cap market? Consider incorporating ETFs like VTWO and IWM into your investment strategy. These funds offer broad exposure to a diverse range of small-cap companies, enabling you to benefit from their potential for performance. VTWO, tracking the CRSP US Small Cap Index, provides a comprehensive view of the small-cap universe. Meanwhile, IWM, mirroring the Russell 2000 Index, showcases the top successful small-cap companies.

- Integrating VTWO and IWM can help you optimize your portfolio by reducing overall risk and potentially increasing returns.

- Remember that small-cap investments can be more fluctuating than large-cap stocks, so diligent research and a structured investment strategy are essential.

Unlocking Small Cap Potential: Strategies for Navigating UWM and IWM

Small-cap stocks provide a unique opportunity for investors seeking substantial returns. However, their inherent volatility can pose significant challenges. The iShares S&P Small-Cap 600 ETF and the Schwab US Small-Cap ETF are two popular ETFs that provide investors with access to this dynamic market segment.

In order to optimize your returns, it is essential to adopt a well-defined approach. First, conducting thorough research on individual companies How to invest in VTWO and IWM for diversified small-cap exposure within the ETFs' holdings. Analyze their financial statements, growth prospects, and competitive advantages.

Next, diversify your portfolio across multiple sectors and industries to mitigate risk. {Lastly|Finally|, remember that investing in small-caps is a short-term endeavor and requires patience and discipline.

Discover The Ultimate Guide to Leveraged Small-Cap Investing: UWM, IWM, and Beyond

Dive into the dynamic world of leveraged small-cap investing with this comprehensive guide. Explore the potential profits and volatility associated with this exciting asset class. We'll delve into popular ETFs like UWM and IWM, providing you with the tools to navigate these markets effectively. Learn how to target promising small-cap stocks, understand leverage ratios, and control risk. Whether you're a seasoned investor or just begining, this guide will provide invaluable insights for your small-cap investing journey.

- Uncover the details of leveraged ETF investing

- Harness ETFs like UWM and IWM to amplify your returns

- Review small-cap stocks for growth potential

- Craft a diversified small-cap portfolio

- Reduce risk through careful position sizing and stop-loss orders

Spencer Elden Then & Now!

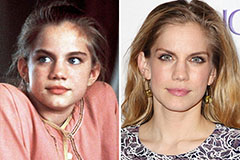

Spencer Elden Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!